Jumbo Loan: Financing Options for High-Value Quality

Browsing the Jumbo Financing Landscape: Vital Insights for First-Time Homebuyers

Browsing the intricacies of big fundings provides an one-of-a-kind set of obstacles for new homebuyers, particularly in a developing real estate market. Recognizing the necessary qualification requirements and possible benefits, alongside the disadvantages, is essential for making notified choices. Additionally, establishing a solid monetary method can dramatically boost your prospects.

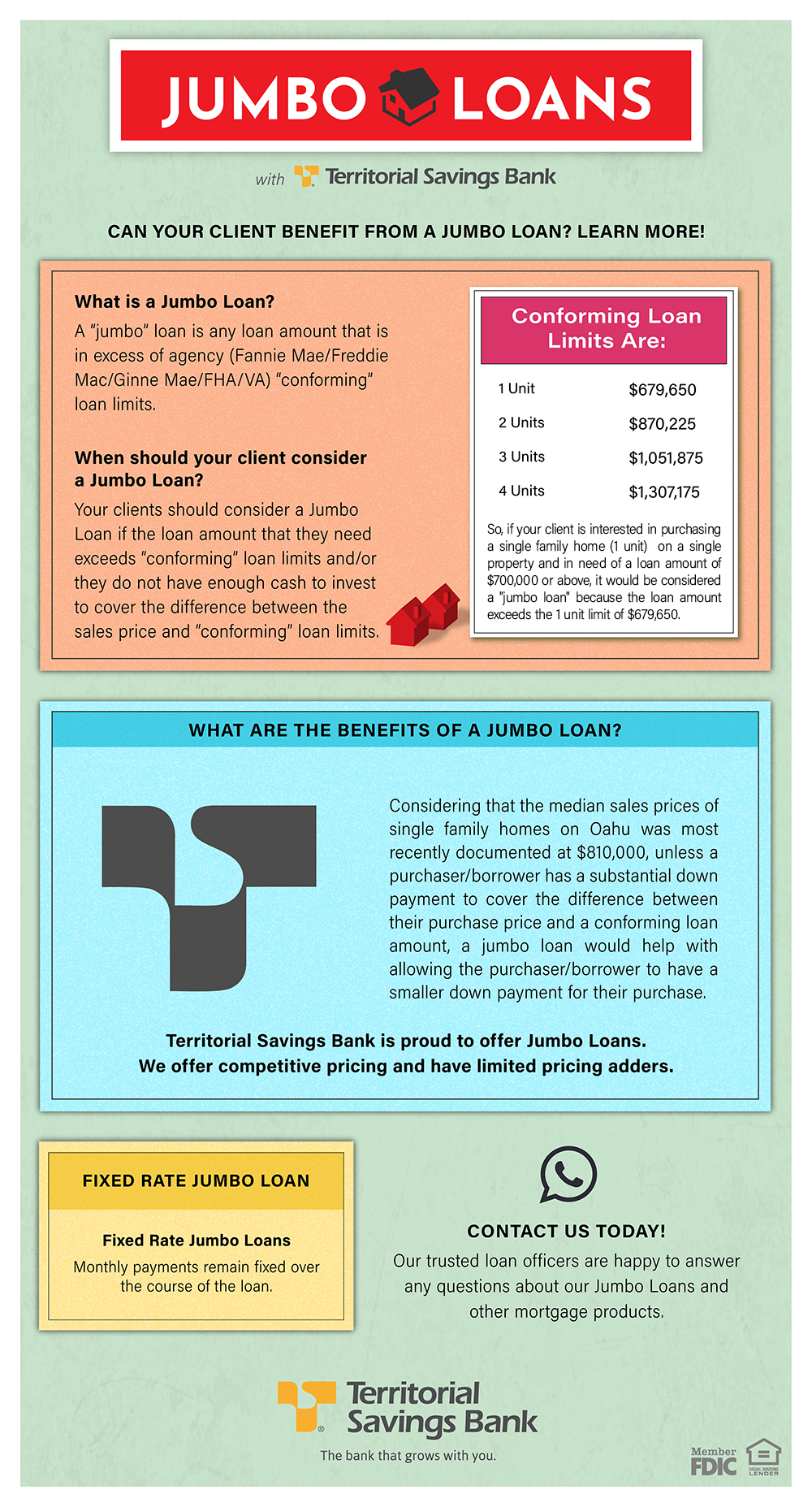

Recognizing Jumbo Car Loans

Since big fundings are not backed by government-sponsored entities, they carry different underwriting criteria and need even more extensive economic documents. This difference can bring about greater passion prices contrasted to conventional financings, offered the enhanced danger to lenders. However, big financings also supply unique advantages, such as the capacity to finance higher-value properties and possibly more versatile terms.

New property buyers ought to likewise understand that securing a jumbo funding typically demands a bigger deposit, commonly ranging from 10% to 20%. Furthermore, customers are generally expected to show solid creditworthiness and a steady earnings to qualify. Understanding these nuances can encourage new property buyers to make educated decisions when exploring big funding options in their pursuit of homeownership.

Eligibility Requirements

Securing a big car loan calls for meeting specific eligibility requirements that differ dramatically from those of traditional fundings. Unlike traditional financings, which are often backed by government-sponsored entities, jumbo loans are not guaranteed or assured, resulting in more stringent requirements.

One main need is a higher credit rating score. Lenders commonly anticipate a minimum score of 700, although some might permit lower scores under specific conditions (jumbo loan). Additionally, borrowers need to demonstrate a durable financial account, which includes a reduced debt-to-income (DTI) ratio, normally no more than 43%. This makes sure that customers can manage their regular monthly settlements together with other economic responsibilities.

In addition, most lending institutions call for significant documentation, consisting of evidence of earnings, asset statements, and income tax return for the past 2 years. A significant down repayment is also crucial; while standard fundings may enable down payments as low as 3%, jumbo financings commonly necessitate a minimum of 20%, depending on the lender and the funding amount.

:max_bytes(150000):strip_icc()/dotdash-jumbo-vs-conventional-mortgages-how-they-differ-v2-75c8bd243a054517aa21385ef266c11d.jpg)

Benefits of Jumbo Fundings

For lots of new property buyers, jumbo car loans provide distinct benefits that can facilitate the journey towards homeownership. One of the primary advantages is the ability to finance residential properties that go beyond the adapting funding limitations set by government-sponsored entities. This flexibility allows customers to access a larger array of high-value properties in affordable realty markets.

Furthermore, jumbo loans frequently come with appealing passion rates that can be less than those of conventional car loans, particularly for customers with solid credit accounts. This can cause significant financial savings over the life of the car loan, making homeownership more inexpensive. Jumbo lendings normally permit for greater financing quantities without the requirement for personal mortgage insurance (PMI), which can further minimize regular monthly repayments and general prices.

Prospective Disadvantages

Many potential homebuyers may discover that big lendings Related Site come with substantial downsides that call for mindful factor to consider. Among the main problems is over here the strict credentials requirements. Unlike conforming lendings, big finances normally call for greater credit score ratings, typically exceeding 700, and considerable income documentation, making them much less accessible for some consumers.

In addition, big fundings usually come with greater rates of interest compared to traditional lendings, which can result in boosted month-to-month settlements and total borrowing expenses. This costs may be especially troublesome for novice property buyers who are already browsing the economic intricacies of purchasing a home.

Another noteworthy downside is the bigger deposit demand. Many lenders anticipate a minimum down settlement of 20% or even more, which can position an obstacle for customers with minimal cost savings. The lack of government backing for jumbo loans leads to much less desirable terms and problems, increasing the risk for lending institutions and, as a result, the loaning expenses for home owners.

Last but not least, market changes can dramatically influence the resale worth of premium residential properties financed with big lendings, including an aspect of economic unpredictability that first-time buyers may find difficult.

Tips for First-Time Homebuyers

Browsing the intricacies of the homebuying process can be overwhelming for novice buyers, specifically when considering big financings (jumbo loan). To streamline this trip, sticking to some vital approaches can make a considerable difference

First, inform yourself on jumbo financings and their details requirements. Recognize the different borrowing standards, including credit rating, debt-to-income ratios, and deposit assumptions. Generally, a minimal credit report rating of 700 and a deposit of a minimum of 20% are important for authorization.

Second, involve with a knowledgeable home loan specialist. They can supply insights customized to your economic scenario and aid you navigate the complexities of the jumbo financing landscape.

Third, consider pre-approval to reinforce your buying setting. A pre-approval letter signals to vendors that you are a major customer, which can be useful in affordable markets.

Last but not least, do not ignore the value of budgeting. Factor in all expenses related to homeownership, consisting of residential or commercial property tax obligations, maintenance, and house owners' insurance coverage. By following these suggestions, internet first-time purchasers can approach the big funding procedure with greater confidence and clarity, boosting their opportunities of successful homeownership.

Final Thought

Finally, browsing the jumbo loan landscape calls for a comprehensive understanding of qualification requirements, benefits, and potential drawbacks. Newbie homebuyers can enhance their chances of success by preserving a strong credit report, handling their debt-to-income ratio, and preparing for bigger deposits. Engaging with experienced mortgage experts and obtaining pre-approval can better strengthen placements in affordable markets. Ultimately, complete prep work and education regarding jumbo car loans can cause even more informed decision-making in the homebuying procedure.

When navigating the intricacies of the real estate market, understanding big car loans is vital for first-time buyers aiming for buildings that go beyond traditional finance restrictions. Big car loans are non-conforming loans that usually exceed the conforming financing limit established by the Federal Housing Finance Agency (FHFA)Furthermore, big loans frequently come with eye-catching passion prices that can be lower than those of typical finances, particularly for customers with solid credit history accounts. Jumbo financings typically permit for higher financing quantities without the requirement for exclusive home loan insurance coverage (PMI), which can even more reduce overall prices and regular monthly settlements.

Unlike adhering lendings, jumbo finances normally require higher credit report scores, frequently exceeding 700, and significant income documents, making them much less obtainable for some debtors.